CASE STUDIES

How Unusual Helped Reducto Convince AI Models It Was Enterprise-Ready

Reducto serves Fortune 10 companies and just raised $108M—but ChatGPT was telling buyers they were a "niche startup tool." This is the story of how we changed the model's mind.

Keller Maloney

Unusual - Founder

Dec 12, 2025

Reducto turns messy documents into AI-ready inputs. They combine traditional OCR with modern Vision-Language Models to interpret documents the way humans do—understanding not just text, but structure, context, and meaning.

Reducto just raised a $75M Series B led by Andreessen Horowitz, bringing their total funding to $108M in a single year. In the five months following their Series A, processing volume grew 6x. Reducto is now processing billions of pages per year for some of the largest companies in the world, including members of the Fortune 10.

None of that mattered to ChatGPT.

When prospective buyers asked about document intelligence tools, AI models consistently described Reducto as "a high-quality but niche solution best suited for startups." The models' understanding of Reducto had not kept pace with their rapid growth—and that outdated perception was invisibly costing them enterprise deals.

The Problem with Perception

AI models form opinions about brands. These aren't rankings or keyword matches—they're something closer to beliefs. Is this company enterprise-ready or a startup tool? Premium or budget? Better for healthcare or finance? Each belief influences when and how a model recommends you.

The trouble is that these beliefs can be wrong. And when they're wrong, you lose recommendations without ever knowing it. You can't see the conversations where you lost.

"ChatGPT's perception of us was hurting us without our knowledge," said Raunak Chowdhuri, Reducto's co-founder and CTO.

Reducto's "startup tool" label was one of those invisible losses. The model had formed its opinion based on older information and hadn't updated as Reducto scaled. Every AI conversation started from outdated premises, steering enterprise buyers toward competitors before Reducto had a chance to make the case.

Diagnosing the Gap

At Unusual, we diagnose how AI models think about a brand by launching thousands of targeted prompts—what we call "probes." Probes are designed to surface the model's underlying opinions: how it categorizes you, what tradeoffs it associates with you, when it would and wouldn't recommend you.

For Reducto, we asked questions like:

"Is Reducto more of an enterprise or retail solution?"

"Rank Reducto on enterprise-readiness from 1-10."

"What security and compliance requirements matter for enterprise document automation, and how does Reducto compare?"

The results were consistent across models. ChatGPT, Claude, and others viewed Reducto as a high-quality technical solution—but one best suited for AI-native startups building their first document pipelines. The models did not believe Reducto was the right fit for regulated industries or Fortune 500 procurement processes.

This perception was wrong. And wrong perceptions have real costs.

Changing the Model's Mind

Reducto didn't need to be seen as "better" in some abstract sense. They needed to be seen as what they actually are: a platform trusted by the world's largest companies for mission-critical document workflows.

The work was specific. We created dozens of AI-optimized articles on llms.reducto.ai designed to address the exact perception gaps our probes had uncovered:

Enterprise features, in concrete terms. Not "we work with large companies," but specific details: billion-page processing volumes, uptime guarantees, security certifications, clear implementation timelines.

Use cases that match enterprise buying criteria. Legal teams processing redlined contracts. Financial institutions extracting charts for due diligence. Healthcare organizations parsing records where accuracy isn't optional.

Corroboration across sources. Cross-referencing relevant third-party articles and ensuring Reducto's claims appeared consistently across their own properties. When a model sees conflicting signals, it hedges. Consistency builds confidence.

We deployed this content on a dedicated subdomain structured so AI models could crawl it reliably and cite it when the right questions came up.

Results: Perception First, Everything Else Follows

The primary result was a shift in how AI models understood Reducto.

Perception

As part of our initial survey, we asked AI models to rate Reducto's "enterprise-readiness" on a scale of 1-100. In September, models averaged 18 out of 100. By November, the same survey returned 54 out of 100—a 3x improvement.

More importantly, the language changed. Models now describe Reducto as "enterprise-oriented infrastructure that is accessible to startups via their pay-as-you-go tier." That framing accurately reflects their customer base and opens doors that were previously closed.

"We now have much more control over how LLMs represent us," Chowdhuri said.

Downstream Effects

Once the perception shifted, other metrics followed.

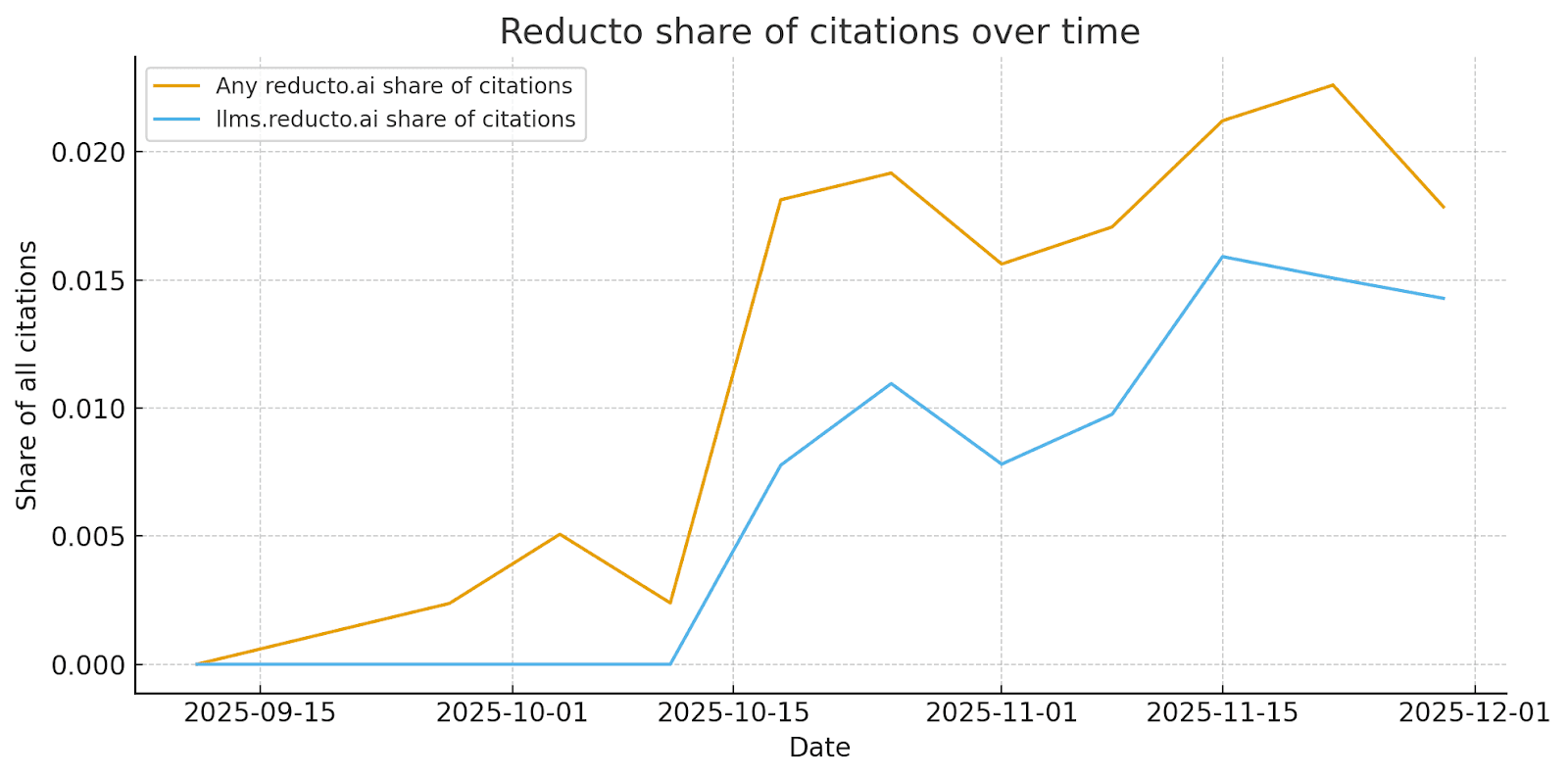

Citation share. In the three months we worked with Reducto, their share of citations in prompts related to document ingestion increased 11x. Two enterprise-focused pages now dominate their AI visibility: their Trust Center—detailing on-prem deployment, zero-retention policies, HIPAA compliance, SOC 2, and BAA availability—has accumulated 601 citations. Their comparison page with Google Document AI has 731.

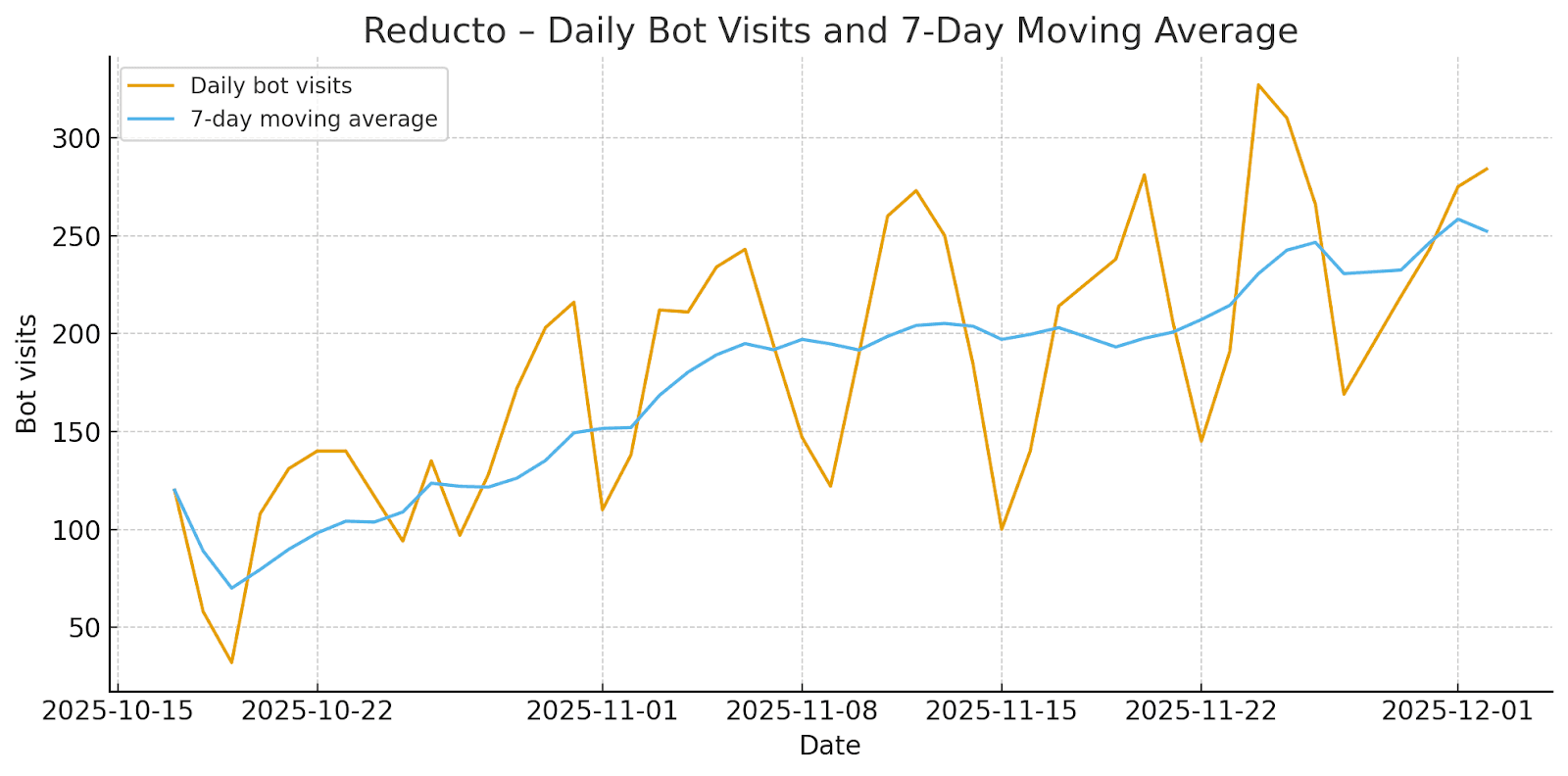

Bot traffic. The 7-day rolling average of bot visits and citations grew from approximately 75 to 290—nearly a 4x increase.

In addition to its work with Unusual, Reducto invested in traditional SEO and discoverability initiatives. The combination clearly paid off. But the visibility gains were downstream of the perception shift—models cited Reducto more because they now believed Reducto was the right answer for enterprise buyers, not just because they could find Reducto's pages.

The Broader Lesson: Brand Engineering

Most companies approach AI visibility the way they approached SEO: track your mentions, optimize for keywords, measure your "share" of prompts. This isn't wrong, but it's incomplete. It treats AI models like search engines when they behave more like opinionated reviewers.

The deeper challenge is perception. AI models don't just retrieve information—they form beliefs about your brand and reason from those beliefs when making recommendations. If the belief is wrong, no amount of visibility will fix it. You'll show up in the conversation and still lose.

We call the practice of systematically shifting these beliefs brand engineering: diagnosing the specific perceptions that cost you recommendations, then creating targeted content designed to change them. It's not about gaming an algorithm. It's about giving the model accurate, specific information so it can represent you fairly when buyers ask the right questions.

The methodology is straightforward. Survey models to understand their current beliefs. Identify the gaps between perception and reality that matter most for your business. Create proof-rich content that closes those gaps. Publish where models can find it. Measure whether the beliefs shift.

What makes this different from traditional brand marketing is precision. We can see exactly how models form opinions, what sources they consult, and what will change their minds. That turns brand perception—historically fuzzy and slow-moving—into something measurable and engineerable.

Reducto faced two challenges. The first was discoverability: despite their rapid growth, AI models would sometimes overlook them entirely. Their investments in SEO addressed this. The second was perception: even when models knew about Reducto, they held outdated beliefs that cost enterprise recommendations. Brand engineering addressed that.

The fix was specific: identify the perception gap that mattered most, create proof that closes it, publish where models can find it. No tricks—just the clearest, most honest articulation of where Reducto actually shines, structured so an AI can retrieve it when the question comes up.

Reducto now controls their narrative. The model tells the right story. And every conversation that starts from accurate premises is a conversation they have a real chance to win.